Independent cannabis dispensaries across the nation are facing an existential crisis as a persistent recreational cannabis supply shortage, coupled with complex regulatory landscapes, pushes many to the brink of closure. This ongoing issue is a significant trending topic in cannabis news, leaving small business owners struggling to keep their doors open.

The Scarcity Crisis: Cultivation, Licensing, and Logistics Bottlenecks

The core of the problem lies in a multifaceted supply chain breakdown. In states like Minnesota, the rollout of recreational cannabis has been severely hampered by a critical lack of product. Dispensary owner Mark Eide, who received a license in August 2025, is unable to stock his shelves, reporting constant calls from customers he must turn away. Eide is one of approximately 40 licensed dispensaries waiting for supply, a situation directly attributable to insufficient licensed cultivators and a slow start to the growing season. Minnesota’s Office of Cannabis Management estimates a need for 1.5 to 2 million square feet of cultivation canopy, yet the state currently has only around 60,000 square feet available, capable of meeting just 3% of projected demand.

Beyond cultivation, licensing delays at both state and local levels contribute to the scarcity. In California, past licensing backlogs have threatened the supply chain, potentially collapsing it and leaving store shelves depleted. Similarly, New York’s nascent legal market is grappling with a “supply crunch,” where 78% of dispensary owners report suppliers limiting shipments, and 53% of cultivators are unable to meet order requests. This is partly due to changes in growing practices, with many cultivators planting less in 2024.

Further compounding the issue are insufficient testing facilities and transportation logjams. While some states have a limited number of licensed testing labs, backlogs can prevent products from reaching the market. Moreover, federal laws prohibiting interstate cannabis transport, combined with domestic trucker shortages, create additional barriers for distribution.

Independent Dispensaries on the Brink

For independent dispensaries, these widespread supply issues translate directly into financial distress. Mark Eide in Minneapolis has already been forced to lay off two employees, including his brother, and is contemplating selling his business before he can even sell recreational cannabis. The initial context highlights similar struggles, with owners considering exiting the market. The high operational costs of running a dispensary—rent, staffing, compliance—become unsustainable when there is no product to sell.

While larger medical cannabis operators, such as RISE and Green Goods in Minnesota, have begun recreational sales, often as some of the few wholesale suppliers available, independent businesses are left scrambling for limited inventory. This uneven playing field intensifies competition, further pressuring smaller entities already disadvantaged by the supply crunch.

Navigating the Regulatory Maze

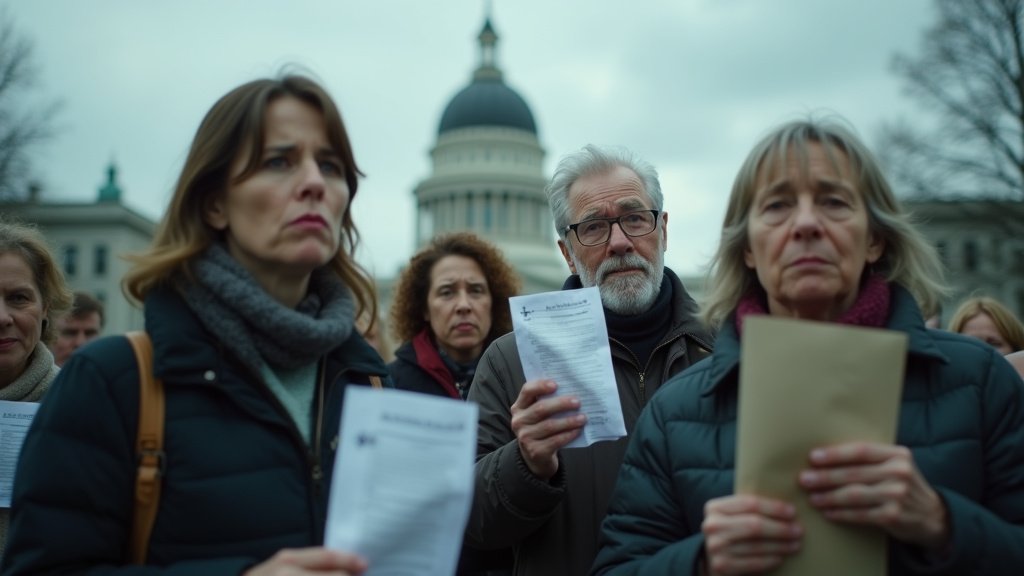

Local regulations also present significant hurdles. In Milford, Delaware, the Fresh Dispensary holds a state conversion license but is barred from recreational sales due to a city ordinance banning them. Despite state legalization, municipal control allows towns like Milford to prohibit sales, leading to legal battles and uncertainty for businesses like Fresh Dispensary. Texas is also implementing new regulations for consumable hemp THC products, with enforcement beginning October 17, 2025, focusing on age verification and prohibiting sales to minors, demonstrating a tightening regulatory environment that can impact product availability and business operations.

A Tale of Two Markets

While independent retailers struggle, the broader cannabis industry shows varied trends. In Eureka, California, a new business named ‘Black Market Cannabis’ has received approval, suggesting ongoing development within the sector. Globally, Tilray Brands is expanding its medical cannabis operations into Panama through a joint venture, signaling growth for larger corporations in specific markets. However, these expansions often occur in distinct legal or medical frameworks and do not alleviate the systemic supply issues plaguing newly established or expanding recreational markets.

The Path Forward

The current landscape paints a grim picture for independent cannabis dispensaries. The news underscores a critical need for systemic reform to address licensing backlogs, expand cultivation capacity, streamline testing and transportation, and create a more balanced regulatory environment. Until these issues are resolved, the fight for survival among small businesses in the burgeoning cannabis industry is set to continue, impacting consumer access and the economic potential of this rapidly evolving sector.