WASHINGTON D.C. – A sweeping federal ban on most intoxicating hemp-derived THC products, tucked into a government funding bill signed by President Donald Trump, is set to dramatically reshape the nation’s hemp industry. The new legislation, which takes effect in one year, replaces the existing 0.3% delta-9 THC by dry weight standard with a strict limit of 0.4 milligrams of total THC per container, a change expected to eliminate over 95% of the current market and jeopardize more than 300,000 jobs.

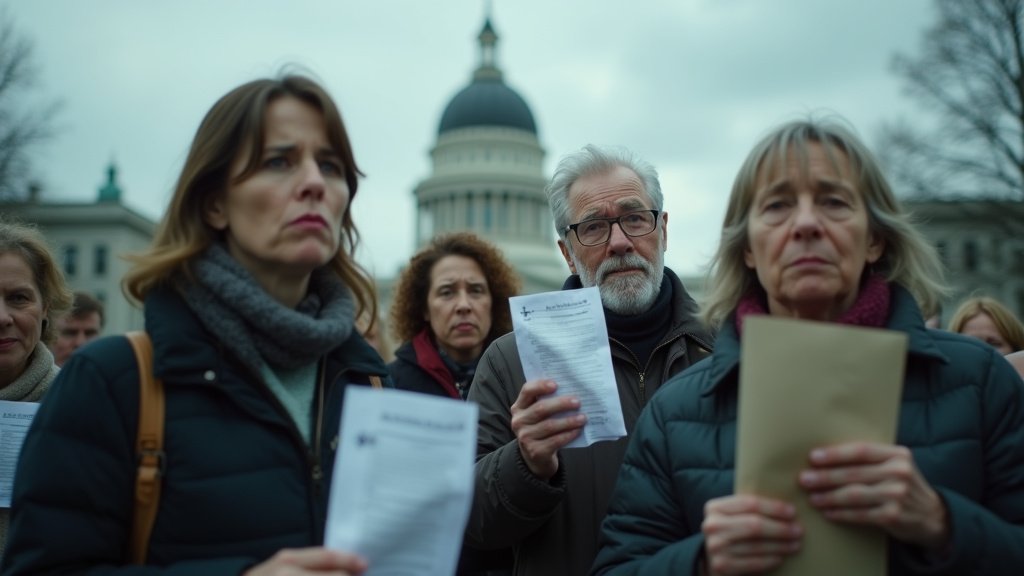

The measure, enacted as part of the legislation to end a record-long government shutdown, has sent shockwaves through the estimated $28 billion to $30 billion hemp sector, which flourished under the more permissive 2018 Farm Bill. Industry advocates are scrambling, calling the move a “seismic shock” and a “prohibition” that could lead consumers to unregulated black markets.

Redefining Hemp: The 0.4mg THC Limit

The core of the new federal restriction lies in its redefinition of legal hemp. The 2018 Farm Bill originally legalized hemp by defining it as any cannabis plant containing no more than 0.3% delta-9 THC on a dry weight basis. This distinction removed hemp from the Controlled Substances Act, inadvertently creating a legal pathway for intoxicating hemp-derived products like Delta-8 THC, Delta-10 THC, and THCA flower.

The new legislation tightens these rules significantly. It mandates that legal hemp products must contain no more than 0.4 milligrams of total THC per container. “Total THC” is now defined to include delta-8, delta-10, THCA, and any other cannabinoids that have similar intoxicating effects. Furthermore, the ban targets synthetic cannabinoids manufactured outside the plant. The Food and Drug Administration (FDA) will be tasked with compiling lists of naturally occurring and synthetic cannabinoids, adding another layer to the evolving regulatory landscape.

The Farm Bill Loophole That Sparked an Industry Boom

Prior to this federal action, the 2018 Farm Bill was hailed for revitalizing hemp agriculture and creating new economic opportunities. However, a perceived loophole allowed companies to convert CBD extracted from hemp into potent intoxicating cannabinoids, bypassing the stricter regulations and taxes associated with state-legal cannabis markets. These products proliferated across the country, available online and in convenience stores, often packaged in ways that appealed to minors, raising public health and safety concerns.

This growth attracted significant attention, leading to a bipartisan push from 39 state attorneys general urging Congress to close the loophole and establish clearer federal guidelines. They cited increased pediatric exposures and the sale of unregulated products as major concerns.

Industry Fallout and Economic Repercussions

The implications for the hemp industry are profound. The U.S. Hemp Roundtable estimates that the ban could wipe out 95% of businesses and cost states approximately $1.5 billion in lost tax revenue. Businesses face product removal from interstate commerce, potential criminal exposure, and severe disruptions to supply chains.

Supporters of the ban, including the regulated cannabis industry and major alcohol lobbies, argue it is a necessary step to ensure consumer safety, prevent underage access, and create a more equitable market. They contend that the hemp industry’s rapid growth was driven by unregulated “bad actors” exploiting a flawed law.

Conversely, many in the hemp industry express dismay, arguing that the broad restrictions will penalize legitimate businesses and consumers who rely on these products for wellness. “Prohibition without regulation will shift these products to the black markets,” warned the U.S. Hemp Roundtable, advocating for a regulatory approach similar to alcohol or traditional cannabis markets.

A Year of Uncertainty and Advocacy

The legislation includes a crucial 365-day implementation window, pushing the full enforcement of the ban to late 2026. This grace period offers a narrow window for industry advocates, lawmakers, and stakeholders to push for amendments, develop alternative regulatory frameworks, or prepare for compliance. Senators like Rand Paul and Thomas Massie opposed the measure, attempting to introduce amendments to strike the hemp provision, but their efforts failed.

The future of the trending hemp market now hangs in the balance, with industry leaders focused on lobbying efforts to redefine the upcoming regulations, aiming to achieve “365 days to regulate, not ban.” The news underscores the complex and evolving nature of cannabis policy in the United States, highlighting ongoing debates about balancing consumer access, public health, and economic development within the burgeoning cannabis and hemp sectors.