2025 proved a pivotal year for Canadian cannabis. Major shifts reshaped the industry landscape. Regulations evolved significantly across the country. The sector’s economic contribution continued to grow. Consumer trends also showed notable changes.

Regulatory Overhaul Sweeps the Nation

Federal regulations underwent a significant update in March. Health Canada introduced sweeping changes. These focused on licensing and production processes. Packaging and labeling requirements saw increased flexibility. Security measures and record-keeping were also streamlined. Multi-colored packaging became more prevalent. QR codes offered consumers more product information. Peel-back and accordion labels provided additional details. Transparent packaging and cut-out windows also appeared. Furthermore, the 1-gram limit for pre-rolled cannabis was removed. Administrative burdens for businesses were reduced.

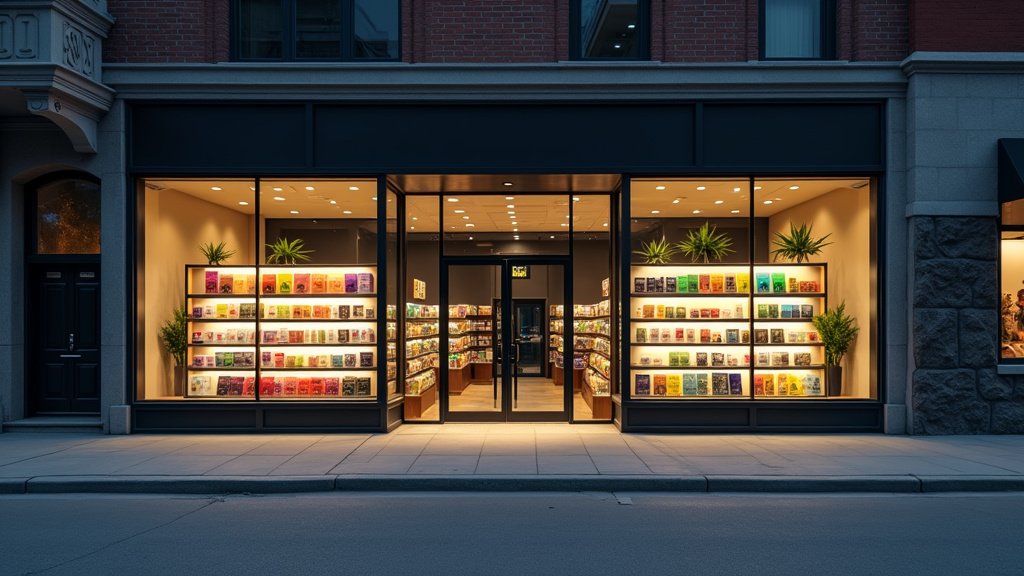

Provincial governments enacted key policy adjustments. Ontario removed its exterior visibility rules for retail stores. Cannabis products could now be displayed from outside. This change aimed to create a more welcoming retail environment. Manitoba embraced home cultivation. Residents 19 and older could grow up to four cannabis plants. This new allowance took effect in May. Manitoba also moved to limit cannabis sales to age-restricted stores. Alberta launched its farmgate licensing program. Producers gained the ability to sell directly from their facilities. The province accepted applications for this model. Alberta’s first farmgate store opened in Okotoks by October. This model fosters direct consumer access.

Vape products also saw wider availability. Quebec and Prince Edward Island finalized their vape product rollouts. These were among the last provinces to permit these items. The cannabis vape market is a significant growth segment.

Economic Powerhouse Gains Momentum

The cannabis industry significantly boosted Canada’s overall economy. The first quarter of 2025 saw a GDP contribution of $9.1 billion. Projections indicated the full year’s GDP contribution could reach $10 billion. This sector is a major economic driver.

Furthermore, the industry supported numerous jobs. Over 227,000 jobs were sustained nationwide. The economic impact of this sector is substantial and far-reaching. Consumer spending within the legal cannabis market also increased. Canadians spent over $11.7 billion in Q1 alone. Legal sales now account for the vast majority of this spending. The vape market segment continues its rapid expansion. It represents a key growth area for the entire industry. Market analyses predict continued strong growth for vapes.

Evolving Consumer Landscape and Trends

Product innovation continued at a rapid pace. Cannabis 2.0 and 3.0 products gained considerable ground. Edibles, beverages, and topicals now hold a significant market share. Consumer preferences also showed evolving trends. Bold flavors and unique terpene profiles gained importance. While potency remained a factor, it was no longer the sole driver for many consumers. Popular cannabis strains trended across Canada. Pink Runtz and Jealousy were highly sought after. Godfather OG offered deep relaxation. MAC 1 remained a favored strain among craft producers. The shift from the illicit to the legal market continued. Consumers demonstrated increased trust in regulated products. This trend reinforces the legal industry’s dominance.

Navigating Ongoing Challenges

Despite significant progress, the sector still faced hurdles. Some reports noted a persistent black market presence. High taxes and market oversaturation remained challenges for some businesses. However, the overall trend pointed towards industry maturation. The legal market’s strength continued to grow. This news shows a dynamic and evolving Canadian cannabis sector.